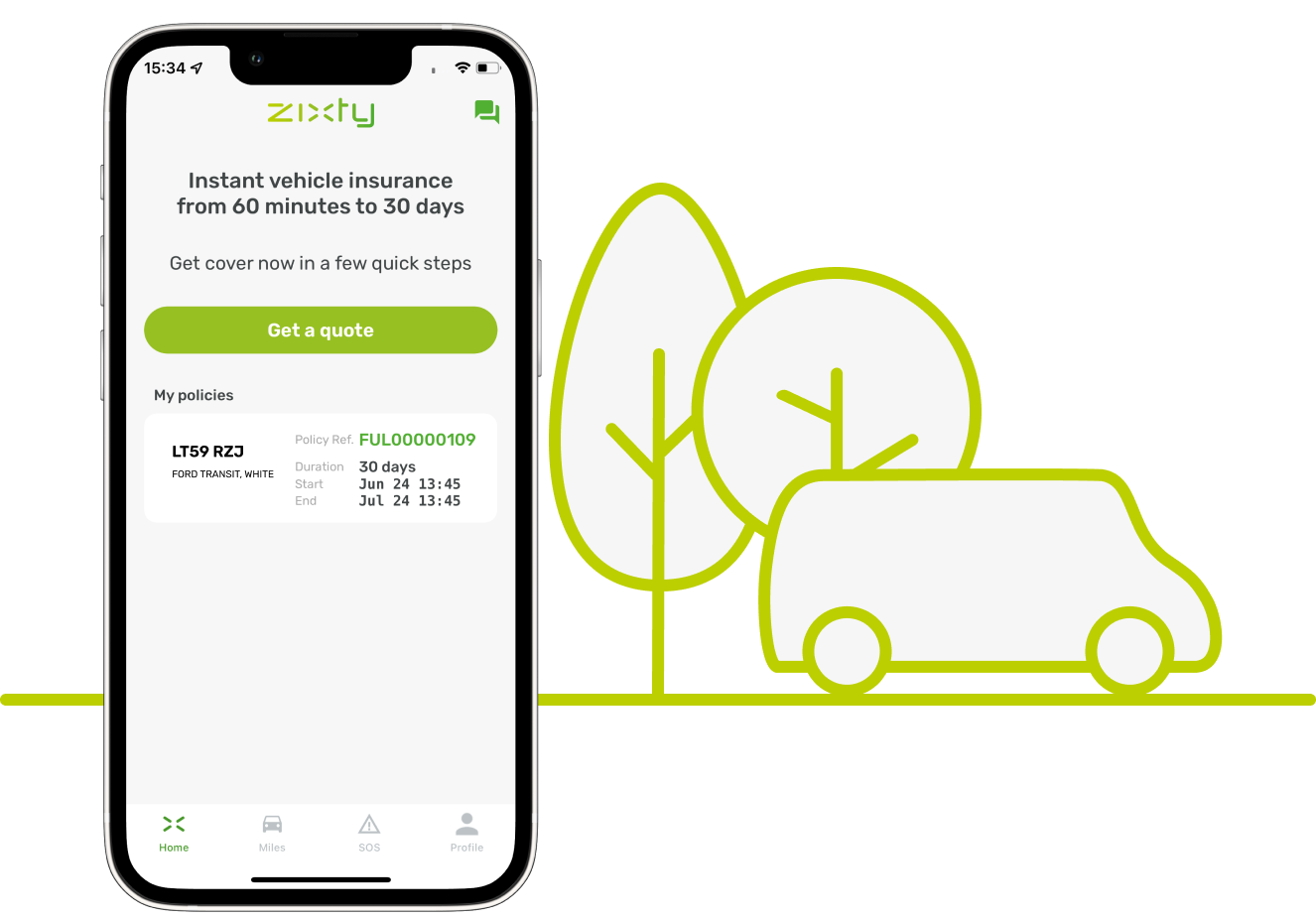

Flexible and easy temporary van insurance with cover from 1 hour to 28 days. Whether you’re in the trade, or want to borrow a van to get some domestic jobs done, get some Zixty and be on the road in minutes. Planet conscious? Offset your driving CO2 for free with optional Zixty Miles. That’s the Zixty way.

Temporary van insurance

Temporary van insurance offers van drivers easy and flexible short term insurance for a wide range of needs. Whether you own a van and need some quick insurance, want to borrow a van to get some big stuff moved, or need to borrow a van to get to a job when your van isn’t available, temporary van insurance is an easy and flexible way to get short term cover for a wide range of needs.

Temporary cover gives you the flexibility to pay only for the time you need – whether that’s an hour, a day, or one month van insurance. If you’ve only paid for a short time and need more time, that’s no problem. Getting another policy through the app takes a few taps. Temporary van insurance can be taken out alongside an annual policy, and the van owner’s No Claim Discount won’t be affected if you need to make a claim.

Temporary van insurance on a mate’s van

Temporary van insurance can be the perfect way to share a van with a friend, or to borrow a van to get some life done. They won’t need to pay to add you to their existing policy, and in the (unfortunate) event that you need to claim, their No Claim Discount (NCD) won’t be affected.

Is short term van insurance only for tradespeople?

Not a bit of it! While lots of vans are owned by people in trades and construction, you definitely don’t need to work in construction to use Zixty temporary van insurance. People from all walks of life borrow vans for those occasional jobs where you need big loads moving around.

Working when things have gone south

When life throws you lemons – there’s Zixty temporary van insurance. Imagine – your van is nicked, damaged, or simply won’t start, and yet you’ve got a job to get to. Either let your customer down and watch TV (maybe not), or tap up a mate and borrow their van for the day – with some Zixty day van insurance.

Types of commercial vehicles

We offer temporary van insurance for a wide range of commercial vehicles, including panel vans and pick-ups. They need to be up to 3.5 tonnes, have a valid MOT, and be worth less than £25,000. At the moment we cannot cover tippers, flat-beds, or drop-sides.

Are tools and trade goods covered?

Tools and trade goods are not covered.

Temporary van insurance that's easy and rewarding

Get a quote

Get a quote

A few quick questions

Done in minutes

Extras

Breakdown Cover

Excess Protect

Zixty Miles

Zixty Miles

CO2 offset your policy

CO2 offset your driving

Get tailored driving tips

Feel Good

Offset your CO2

Save fuel

Smile

Insure with confidence

Our temporary van insurance is backed by trusted insurance names, and as part of the British Insurance Brokers Association, you can be confident that you’re dealing with a legit business. Our van insurance activities are also regulated by the Financial Conduct Authority, providing more reassurance that you’re in safe hands.

What we’re about

Times change, and insurance needs to keep pace. Zixty exists to provide short term van insurance that’s transparent, fair, and most importantly helps people reduce their impact on the environment. By listening to our customers, our future is shaped by your needs.

How does temporary van insurance work?

Temporary van insurance is a flexible type of short term van insurance. Without the hassle or restrictions of an annual policy, it allows you to drive a van for a short period of time without the need to take out an annual insurance policy. Our short term van insurance policies provide comprehensive cover from 1 hour to 28 days, and cover can start in as little as 5 minutes, or up to 28 days in the future.

It takes no time at all to get a quote and buy a policy, and everything you need is right there in the app. When plans change, and you need more cover, it’s just a few taps away. With no annual contract, buy just the cover you need. It’s that easy.

When can I use temporary van insurance?

Temporary van insurance is designed to meet today’s busy lives – flexing to accommodate a wide range of situations. Maybe your van doesn’t start, is in for a service, or has been damaged – yet you need to get to a job. Or you want to borrow a van from someone so that you can get a load of flat-pack furniture back from the home of Swedish meatballs. Maybe you need the apprentice to collect some tartan paint while you’re working. Whether a van is an essential part of your livelihood, or the solution to a domestic job that needs to be done – Zixty is there.

How much temporary van insurance can I get?

Temporary van insurance from Zixty is designed for people who want speed and flexibility from their insurance, but where it might not be possible to predict the future. With cover starting from as little as an hour, if your plans change, then so can Zixty. If you need more cover, simply head over to the app where your details will be saved, and you can get more cover in a few taps.

Key features

- Comprehensive cover

- Replacement lock/ key cover

- New vehicle replacement*

- Social, Domestic, and Pleasure

- Carriage of own Goods

- Breakdown & Excess Protect add-ons

- Legal Liability Cover

- Medical Expenses Cover

- Foreign Travel**

Tailor your cover

- Excess Protect : Protect £250 of your excess

- Breakdown cover : Home-start, roadside, and nationwide recovery with our trusted network

- Zixty Miles : Offset the CO2 from up to 100 miles per day for free

Love the planet

Add Zixty Miles to your policy for FREE and we’ll offset the CO2 from up to 100 miles of driving each day you’re with us. By driving really carefully, we may offset even more CO2 than the driving produced – making your journeys carbon negative.

Key criteria

Driver

- Age : 19 to 75 (Commercial vehicle 21+)

- Licence : Full UK DVLA issued or EU Licence (subject to criteria)

- Licence length : Held 3 months or longer (EU licences 3+ years). Commercial vehicles require 12 months, UK licence only.

- Disqualification : Not been banned in last 5 years

- Points : No more than 6 valid points

- Occupations : Certain occupations excluded

- Residency : UK resident for 12 months or more / 3+ years for EU licence holders

- Drivers : One driver only

Vehicle

- Value : Up to £50,000

- Age : Up to 20 years old

- Private car / Commercial Vehicle: Private cars or commercial vehicles up to 3.5t

- MOT : MOT check performed if no valid MOT cover only applicable to drive to pre-booked MOT

- Permission : Must have owners consent

- Modifications : No after market modifications

- ABI Group : Up to Group 45

- Registration : UK registered right-hand drive

Temporary van insurance guide

What level of cover does temporary van insurance provide?

Zixty temporary van insurance provides comprehensive cover for Social Domestic and Pleasure purposes as well as for commuting to your normal place of work. We also cover business use (carriage of own goods) which covers driving to and from other business locations in your normal course of work for your main occupation (please note no delivery or taxi use is covered). Like most short term van insurance policies it doesn’t cover standalone Glass claims including windscreen claims.

Who takes out temporary van insurance if I’m borrowing a van?

The person who will be borrowing and driving the van needs to take out the Zixty. The borrower will need to have the lender’s permission to use the vehicle.

Who takes out temporary van insurance if I’m lending a van?

If you’ve decided to lend your van to a colleague, a friend, or fact anyone, then it’s up to them to take out a temporary van insurance policy. They’ll need your permission first, and that’s it. In the unfortunate event of a claim involving your van, your insurance and your No Claim Discount are not affected.

Does temporary van insurance cover business use?

Zixty temporary van insurance provides you with Comprehensive cover for Social Domestic and Pleasure purposes as well as for commuting to your normal place of work. We also cover business use (carriage of own goods) which covers driving to and from other business locations in your normal course of work for your main occupation (please note no delivery or taxi use is covered). However, like most short term policies it doesn’t cover standalone Glass claims, including windscreens. You need to ensure that the cover meets your needs before buying a policy.

Can I get 1 hour temporary van insurance?

Zixty temporary van insurance can cover you from 1 hour up to 28 days. If you need longer than 28 days then you’ll need a new policy, which is quick and simple to arrange. Short term insurance isn’t really designed for longer than 28 days and it may be more cost effective to look at other insurance products that are more suitable.

Can I use short term van insurance to tax my van?

Taking out a Zixty short term policy will enable you to demonstrate that you have a valid van insurance policy in place when taxing your van. The DVLA uses the Motor Insurance Database (MID) to check that the van is insured. Please note: It can take up to 48 hours for MID to include insurance details.

Can I use temporary van insurance to learn to drive?

We currently only insure people who have held a full UK DVLA issued driving licence for 12 months or more.

Do I need to own a van to take out short term van insurance?

You don’t need to own a van to take out a short term van insurance policy. Lots of customers take out Zixty insurance because they’re borrowing someone else’s van.

Temporary van insurance FAQs

Do the vehicle and policy get registered on MID?

We will ensure the vehicle is uploaded to the Motor Insurance Database (MID), and removed when cover ends.

Please be aware that it can take up to 48 hours for MID to be updated – something that’s common to all car insurance companies. If you get stopped by the police, your app holds proof of your insurance.

Does temporary van insurance affect the lender's NCD?

Your Zixty short term van insurance policy supersedes the lender’s policy while in force. The lender’s No Claim Discount will not be affected if you need to claim against your Zixty van policy.

Can I take a test-drive using short term van insurance?

Yes. A Zixty short term van insurance policy is designed to cover a test drive – provided that you have the owner’s permission and the van has a valid MOT,

Does the van need to be insured elsewhere?

Provided that the van has a current MOT, and you have the permission of the owner (where applicable), no other van insurance is required.

How soon can temporary van insurance cover start?

If you want immediate cover, you can be on the road in a few minutes, though you can set a date in the future if that’s what you want. Please check your documents for the exact start time of your policy.

Can I drive a SORN van?

Zixty short term van insurance policies do not cover SORN vans.

Can I take out a Zixty temporary van insurance policy to get my van to an MOT?

A Zixty van policy cannot provide cover to take a van for an MOT if the MOT has already expired.

Can I drive abroad with short term van insurance?

Zixty short term van insurance policies provide the minimum level of cover required by the laws of compulsory insurance for you to use the vehicle on road in any country that is a member of the European Union, and any country that has agreed to follow the European Union directives relating to compulsory motor insurance and is approved by the commission of the European Union. Please refer to your policy wording for full details.

Temporary van insurance help and guides

Breakdown Cover

Zixty Rescue Breakdown cover is designed to get you moving and keep you moving.

Excess Protect

Claim back £250 of your Excess in the event of a fault claim on your Zixty policy.

Zixty Miles

Carbon offset up to 100 miles of driving per day, plus a range of other valuable benefits.