Quick, flexible and easy short term car insurance with cover from 1 hour to 28 days. Offset your driving CO2 for FREE with Zixty Miles, as well as enjoying a range of other benefits. Get some Zixty and be on the road in minutes. Short term car insurance with an eco conscience? That’s the Zixty way.

Short Term car insurance

Short term car insurance is a quick and easy way to get temporary cover to drive a car – whether that’s one you own, or one you borrow. This type of car insurance allows you to drive your own car, a friend’s car, or even take a test drive with the owner’s permission. With freedom, flexibility, and saving money in mind, short term car insurance opens up a world of options.

Day insurance

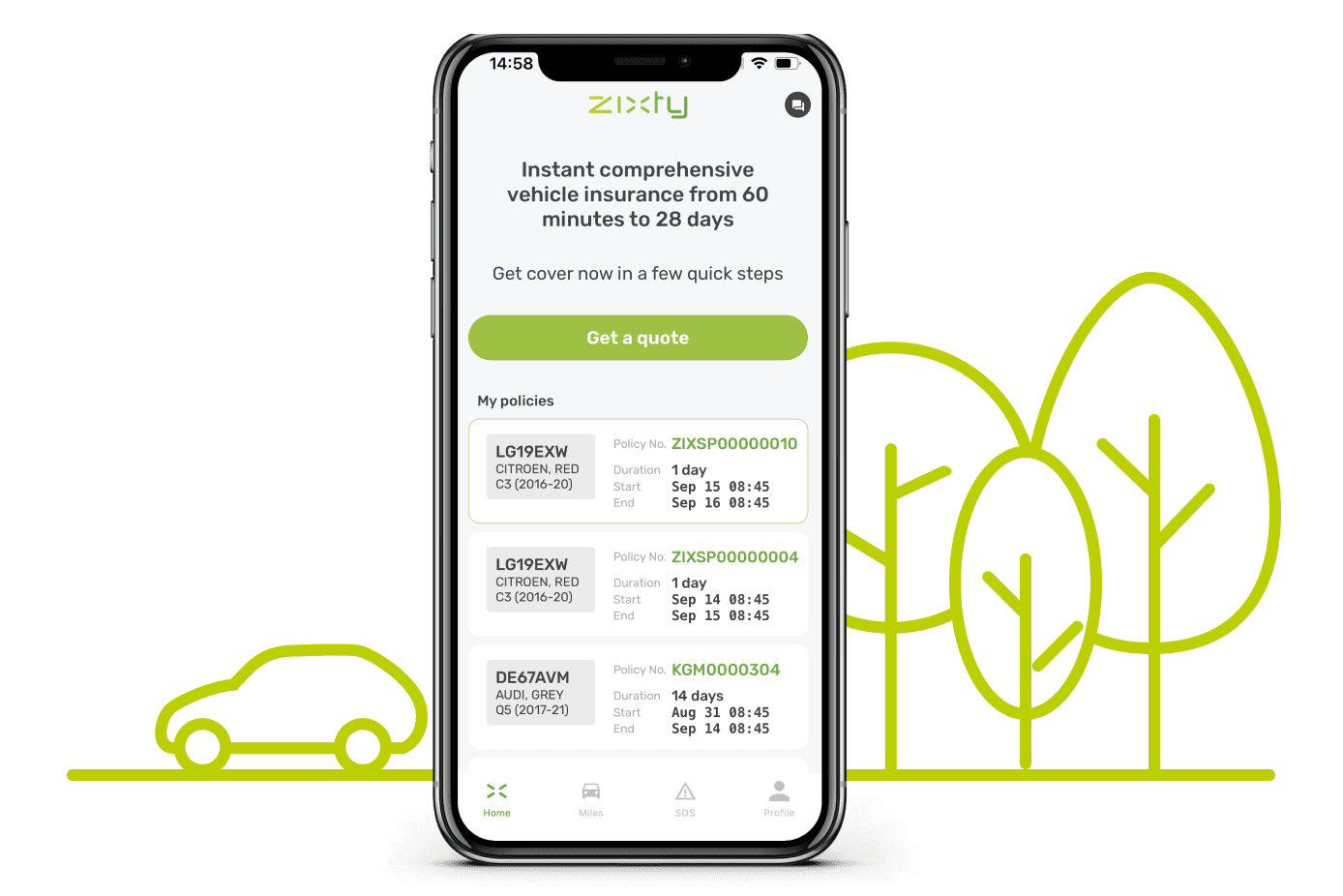

Occasionally also known as “day insurance”, short term car insurance does what it says on the tin, and can be for as little as 1 hour, or up to 28 days. Get a quote through the Zixty app, and your policy can start in as little as 5 minutes time, or on a day and time to suit you. The flexibility doesn’t stop there though. If your plans change, and you need more time, getting more cover takes a few taps and a couple of minutes. Download the Zixty app, get some Zixty, and get on the road today!

Car insurance renewal

Short term car insurance can help if your annual car insurance is about to come to an end, and you want to shop around. Get a short term car insurance policy and take your time shopping around for the best deal on your annual car insurance. If you decide you don’t want to own a car any longer, and want to save money on your car insurance, then short term car insurance could be right for you. Take only the cover that you need for the hours or days that you want.

Temporary car insurance that's easy and rewarding

Get a quote

Get a quote

A few quick questions

Done in minutes

Extras

Breakdown Cover

Excess Protect

Zixty Miles

Zixty Miles

CO2 offset your policy

CO2 offset your driving

Get tailored driving tips

Feel Good

Offset your CO2

Save fuel

Smile

Insure with confidence

Our short term car insurance is backed by trusted insurance names, and as part of the British Insurance Brokers Association, you can be confident that you’re dealing with a legit business. Our insurance activities are also regulated by the Financial Conduct Authority, providing more reassurance that you’re in safe hands.

What we’re about

Times change, and insurance needs to keep pace. Zixty exists to provide short term car insurance that’s transparent, fair and most importantly helps people reduce their impact on the environment. By listening to our customers, our future is shaped by your needs.

Key features

- Comprehensive cover

- Replacement lock/ key cover

- New vehicle replacement*

- Social, Domestic, and Pleasure

- Personal Business Use

- Breakdown & Excess Protect add-ons

- Legal Liability Cover

- Medical Expenses Cover

- Foreign Travel**

Tailor your cover

- Excess Protect : Protect £250 of your excess

- Breakdown cover : Home-start, roadside, and nationwide recovery with our trusted network

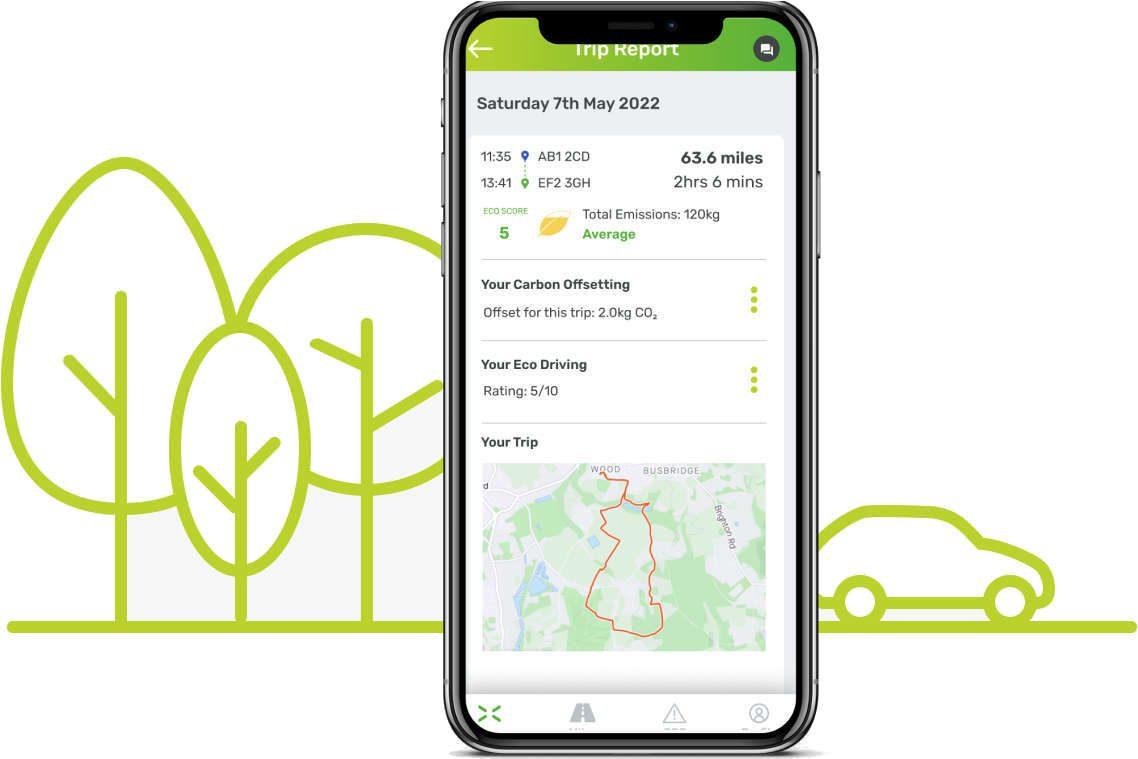

- Zixty Miles : Offset the CO2 from up to 100 miles per day for free

Love the planet

Add Zixty Miles to your policy for FREE and we’ll offset the CO2 from up to 100 miles of driving each day you’re with us. By driving really carefully, we may offset even more CO2 than the driving produced – making your journeys carbon negative.

Key criteria

Driver

- Age : 19 to 75 (Commercial vehicle 21+)

- Licence : Full UK DVLA issued or EU Licence (subject to criteria)

- Licence length : Held 3 months or longer (EU licences 3+ years). Commercial vehicles require 12 months, UK licence only.

- Disqualification : Not been banned in last 5 years

- Points : No more than 6 valid points

- Occupations : Certain occupations excluded

- Residency : UK resident for 12 months or more / 3+ years for EU licence holders

- Drivers : One driver only

Vehicle

- Value : Up to £50,000

- Age : Up to 20 years old

- Private car / Commercial Vehicle: Private cars or commercial vehicles up to 3.5t

- MOT : MOT check performed if no valid MOT cover only applicable to drive to pre-booked MOT

- Permission : Must have owners consent

- Modifications : No after market modifications

- ABI Group : Up to Group 45

- Registration : UK registered right-hand drive

Short term car insurance FAQs

What is short term car insurance?

Short term car insurance is a type of temporary car insurance designed for people who don’t own a car, and want to borrow someone else’s, or to insure a car owned by someone else. Cover is much shorter than annual – generally from an hour to 28 days. Whether you’re buying a car, and need to insure it to get it home, you’re borrowing a friend’s car, or sharing a long drive, flexible insurance can be the answer. Typically offering Comprehensive cover, there are usually differences between annual and short term policies, and you should always check that cover is suitable before buying.

How does short term car insurance differ from annual car insurance?

The headline difference between short term car insurance and annual car insurance is the duration of the cover! Short term car insurance provides cover for a specific number of hours or days (generally an hour up to 28 days), while annual car insurance provides ongoing cover for a year. Short term car insurance is also often more flexible and customisable, allowing you to choose the specific number of days you need cover for, and quickly get more cover if plans change. You should always check that the cover offered by any policy meets your needs before you buy.

How do I buy short term car insurance?

Buying short term car insurance takes just minutes, and there are no long forms to fill out. Simply get a quote online now, or download the Zixty app to get a quote and buy short term car insurance today. In just a few taps you’ll be covered!

Short term car insurance help and guides

What is short term car insurance?

Everything you need to know to get started with temporary car insurance cover.

Short term or annual car insurance?

Discover the key differences between short term and annual car insurance.

How to save money on your car insurance

The ultimate guide to saving money on your car insurance. See the top 15 ways to save!

How do I offset my driving CO2 for FREE?

Carbon offset up to 100 miles of driving CO2 a day for free with Zixty Miles.